MLM Growth Strategies: Scaling with Structure, Tech, and Retention Intelligence

As the global MLM landscape becomes more fragmented, regulated, and digitally saturated, network growth is no longer a function of field enthusiasm or product uniqueness alone. Sustainable, exponential growth in MLM today depends on orchestrated systems—ones that blend predictive analytics, automated operations, regulatory compliance, and field enablement at scale.

Key Takeaways:

- Scalable growth requires infrastructure, not just motivation—integrate onboarding, payouts, and promos into a unified system.

- Predictive analytics reduce churn and optimize performance before visible drops happen.

- Compliance, localization, and embedded reporting are no longer optional in international expansion.

- Agility in comp plan logic and modular architecture enables rapid adaptation to new markets and regulatory demands.

- Growth in 2025 is deeply technical—strategy lives in the platform, not just in the field.

In this article, we’ll break down advanced MLM growth strategies used by fast-scaling companies in 2025, with a focus on scalable infrastructure, cross-border expansion readiness, and platform intelligence. These insights are based on real-world implementations inside

MLM Soft’s platform, which supports networks from 50,000 to over 10 million accounts.

Rethinking Growth: From Volume to Velocity

Traditional MLM thinking often equates growth with total network volume. But in practice, what separates stagnant organizations from those scaling efficiently is not just gross turnover—it’s velocity: how fast new distributors activate, how quickly they start earning, and how efficiently the company can support them at scale.

Key growth metrics to focus on:

- Activation-to-commission time

- Downline compression and depth performance

- Sponsor productivity and orphan rates

- Churn latency (predictive churn vs actual)

- Compensation plan scalability under load

Optimizing these indicators requires not just software, but an architecture of interlocked systems that proactively solve growth bottlenecks before they become visible.

Intelligent Onboarding Is Your Growth Engine

A high-velocity network activates recruits within days, not weeks. And yet, many companies still rely on email sequences and video libraries detached from actual business tools.

Instead, we recommend in-app onboarding layers that are tightly integrated into your commission logic and back office navigation. This allows you to surface dynamic content based on:

- Rank level

- Downline size

- Personal volume trend

- Missed bonuses or cycles

This approach cut early-stage churn by up to 40%. It also enables continuous onboarding, meaning distributors receive new micro-missions and training whenever their business context changes.

For practical implementation, see our breakdown on network reassignment automation—a feature that often triggers contextual onboarding when uplines shift.

Strategic Automation: Not Just CRM, But Core Logic

Automation in MLM often stops at CRM emails or lead assignment. But for real growth acceleration, the automation must touch core MLM logic:

- Automated leg balancing and spillover control

- Smart payout distribution based on multiple wallets

- Real-time cross-checking of promo eligibility

We’ve shown that integrating business logic into automation workflows dramatically reduces operational lag and compliance errors. In a recent project, our client streamlined promotions to auto-activate on live sales data, without manual overrides or post-period reconciliations.

This ties into broader infrastructure needs. In our article on platform scalability beyond 10 million users, we explore how automation pipelines were restructured to enable concurrent logic processing during high-load events like promo spikes or payout runs.

Compliance as a Built-In Growth Enabler

Compliance and growth used to be opposing forces. Today, they are interdependent.

Uncontrolled messaging, informal payment schemes, and undocumented onboarding are the fastest ways to lose regulatory clearance—and with it, your ability to scale internationally.

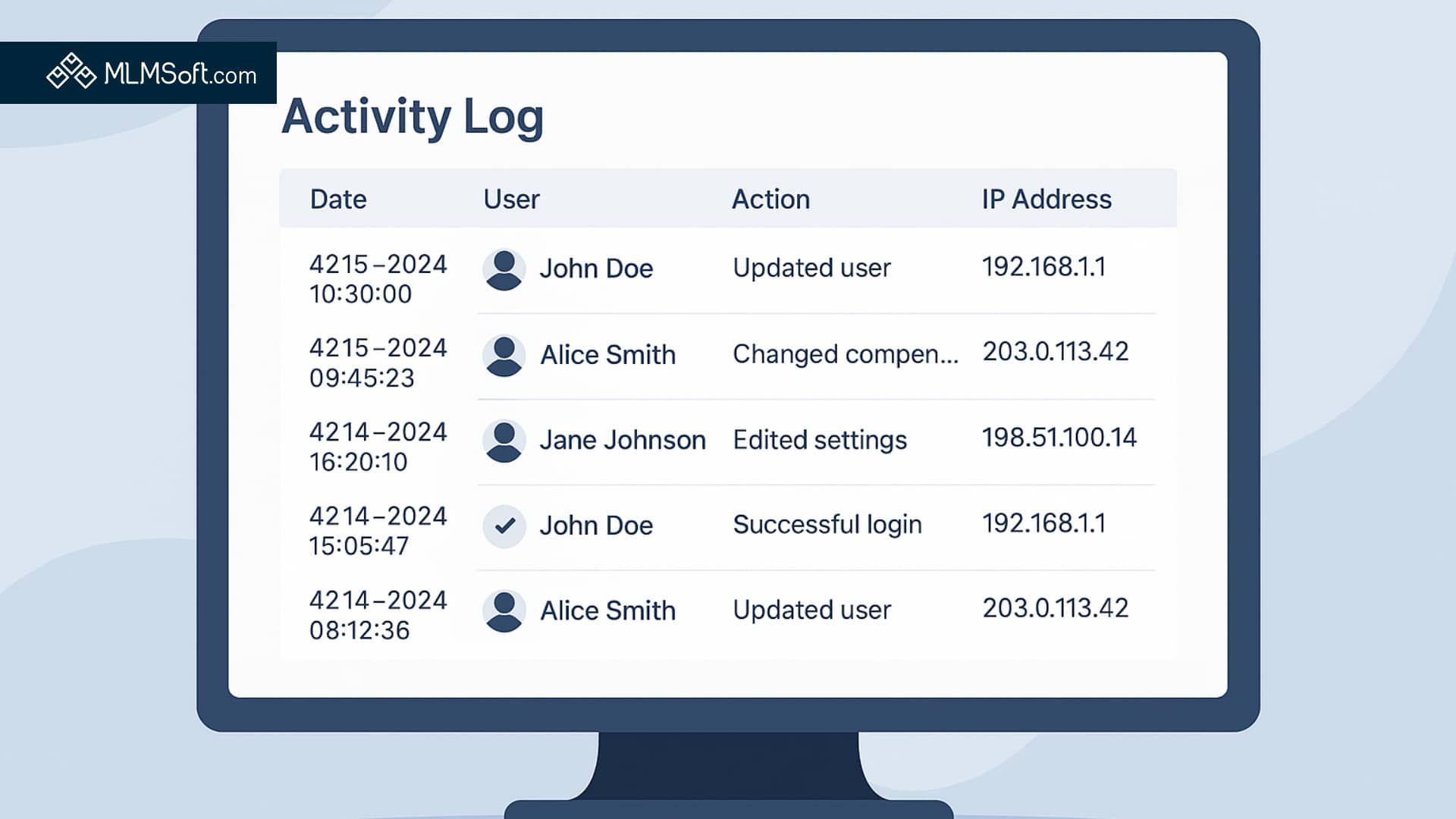

Forward-thinking MLMs now embed terms acceptance, KYC, and data traceability into their distributor journey:

- Dynamic T&C acceptance with version tracking

- Regional logic for document verification

- Audit trails on commission eligibility

Our recent post, Enhancing Compliance with Built-in Terms & Conditions Acceptance, outlines how one client automated legal exposure reduction across 18 markets, including high-risk jurisdictions.

This isn't just about avoiding fines—it improves sponsor confidence, legal defensibility, and partner bank relationships (especially if you're using payout automation or embedded wallets).

Platform Agility: Supporting New Models Without Rebuilds

Growth in 2025 often means testing alternative compensation models: influencer tiers, limited-time unilevel hybrids, or retail-first bonus structures. The traditional monolithic MLM system can’t support this easily.

That’s why headless architecture and modular comp plan engines are key. With MLM Soft, for example, companies are implementing:

- Isolated rank structures per region

- Dynamic promo overlays without breaking base logic

- API-driven calculation rules for integration with mobile commerce

If your current platform requires manual intervention to launch a promo, or rebuilding structures to introduce a retail-only rank, your growth curve will flatten fast. This is especially true in markets experimenting with non-recruitment growth models.

Embedded Reporting as Field Infrastructure

Growth also depends on what your field can see. If distributors and leaders lack visibility into team performance, promo eligibility, or rank thresholds, they disengage.

By embedding reporting directly into distributor dashboards, MLMs reduce support tickets and increase proactive action. For example:

- Team volume graphs by week

- Payout trend forecasting

- Left-right leg comparison (binary-specific)

- Promo cutoff timers

We’ve recently enabled full Metabase report embedding directly inside the back office—not just for admins, but for individual distributors. This empowers leaders to run their own analytics without data exports or BI team involvement.

If you're interested in this capability, read our recent integration case: Metabase in Client Dashboards.

Cross-Market Scaling: When Tech Becomes a Barrier or a Multiplier

The real test of growth strategy comes when entering new countries. But expansion fails more often due to platform limits than market readiness.

From our experience helping companies enter LATAM, Africa, and Southeast Asia, the blockers usually look like this:

- Payout engines that can't support mobile money

- Legacy tax logic that can’t adapt to country-specific VAT rules

- Promo logic that assumes North American calendars

- Commission currency mismatches and exchange errors

Your platform must support multi-market logic natively. Not just in text and currency, but in how compensation, taxes, and workflows adapt to country rules.

If not, every market becomes a custom dev project—and growth stalls.

Leader Retention: Predictive Signals, Intervention Logic, and Mid-Tier Optimization

In most MLM organizations, leadership attrition isn’t sudden—it’s a slow, predictable erosion. Yet the vast majority of companies only track superficial indicators: weekly PV drops, declining login activity, or missed commission thresholds. These lagging signals are useful, but by the time they surface, the leader is already disengaged—or halfway out the door.

High-growth MLMs take a different approach. They build multi-layered predictive churn analytics directly into the platform, not as a reporting add-on, but as part of the core business logic. This means the system actively scans for patterns long before a sponsor submits their resignation or stops responding to their team.

We advise identifying and implementing a set of advanced triggers that go far beyond basic KPIs. These include:

- Lateral leg depth decay: When a leader stops developing across legs and focuses narrowly on one income source, it's often a precursor to disengagement.

- Downline inactivity clustering: A sponsor’s influence can be measured by how many team members stop qualifying within a 2–3 week window.

- Missed bonus thresholds: Leaders who consistently miss mid-tier bonuses despite volume potential may be misaligned with compensation design—or losing motivation.

- Historical rank volatility: A 3-month trend of rank drops followed by stagnation is often a sign that the field can no longer “carry” the leader organically.

- Promo disengagement: Leaders who don’t opt into targeted campaigns or fail to mobilize their teams during volume pushes should be flagged early.

What happens with this data? It’s routed through behavioral triggers that create internal tickets, CRM tasks, or system-generated outreach suggestions. These alerts are directed toward corporate staff, upline executives, or even directly to the distributor, depending on the escalation path. The goal is not to reprimand, but to intervene early with relevance.

Interventions vary: some reps may receive a retention offer or access to exclusive coaching; others might get reassigned to a more active network node—enabled by our network reassignment tool, which can move entire trees based on productivity logic.

By using these metrics in tandem with smart promo targeting and team-level analytics, large organizations can maintain the engagement and output of the “middle layer”—the 60–70% of distributors who are neither new nor elite, but who collectively represent the majority of volume and growth potential. Retaining this cohort is exponentially more efficient than re-recruiting to replace them.

Futureproofing Your Growth Architecture

Sustainable MLM growth doesn’t come from marketing slogans or motivational rallies—it comes from structural resilience. In 2025, the companies that continue to scale are not necessarily those with viral products or charismatic founders. They are the ones that have invested in operational depth and technology maturity.

This begins with infrastructure that auto-scales, especially during high-load events like enrollment blitzes, payout runs, or global promotions. If your platform throttles or slows under pressure, growth becomes a liability rather than an asset.

Equally critical is the compensation engine. It must be able to support legacy logic while evolving to support hybrid plans, retail-centric tiers, regional overrides, and real-time promo overlays. We’ve seen companies lose momentum simply because their architecture couldn’t keep up with incentive design.

Field visibility is another make-or-break capability. Growth-focused companies ensure that every distributor—not just the top 1%—has access to intuitive dashboards showing rank progress, team trends, bonus targets, and historical data. This enables self-correction without constant hand-holding.

And finally, there’s compliance. Regulatory risk is now a core business concern, especially in cross-border operations. MLMs need embedded T&C enforcement, localized tax logic, and automated audit trails—features we’ve built into our compliance infrastructure to support dozens of jurisdictions in real time.

The future of MLM growth is not just about bigger networks—it’s about stronger, more intelligent systems that reduce risk while amplifying opportunity. The difference between a stalled company and a market leader? Often, it’s the invisible layer of process, architecture, and foresight beneath the surface.

Conclusion: Strategy Is Infrastructure

If you’re treating growth as a marketing exercise, you will always hit a limit. But if you build growth into your tech stack, your workflows, and your distributor experience, there is no ceiling.

At MLM Soft, we work with companies scaling from 10,000 to 10 million accounts across more than 50 countries. If you want to know what your infrastructure needs next—not just to grow, but to stay grown—we’re ready to show you.

👉

Request a personalized demo

👉

Contact our team

Interested in Professional MLM Software? Book Free Demo with an Expert!

MLM Soft Cloud Platform is a modern high-performance software to run any multi-level or referral marketing business. Our platform is used by traditional MLM companies in health&beauty segment, as well as other industries using multi-level and/or affiliate marketing to boost their sales: infobusiness, education, real-estate, consulting, crypto, trading, etc.

Discover how we can build a customized solution for your business on MLM Soft Cloud Platform during a demo-call with one of our experts.